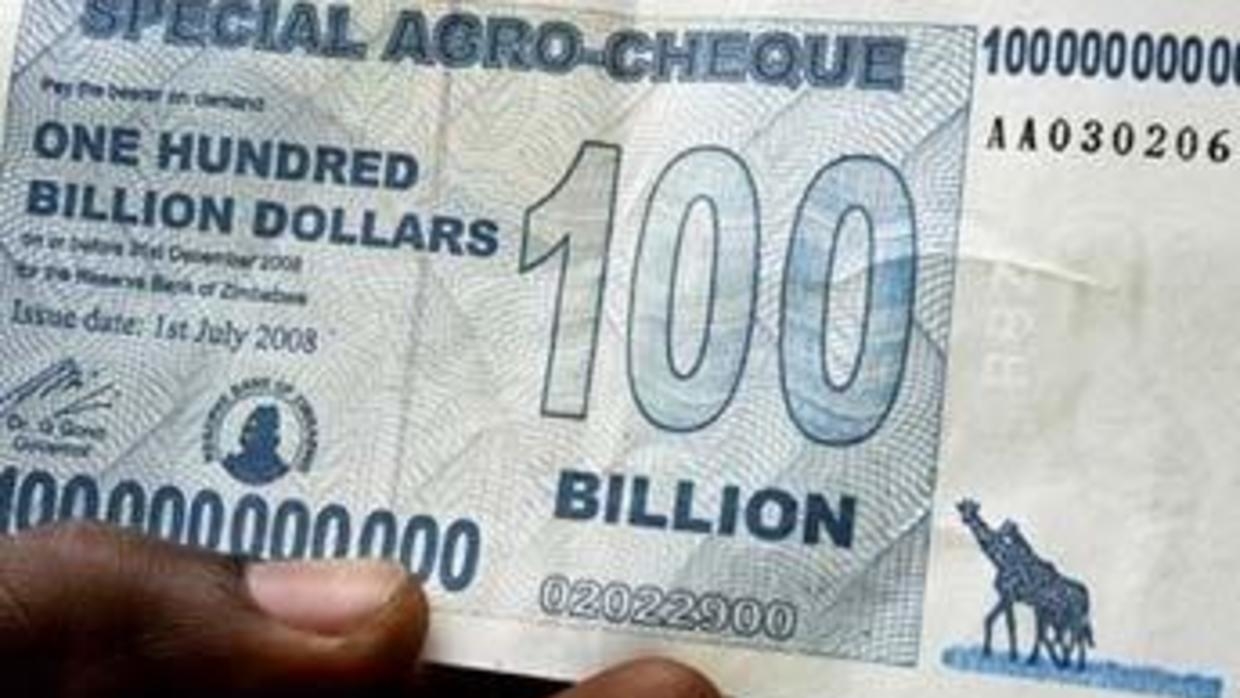

I was 7 years old when Zimbabwe finally descended into official Hyperinflation. It lasted for a period of approximately five years when Zimbabwe in early 2009 stopped printing the Zimbabwe Dollar and returned to using the US Dollar as its legal tender. The largest denominated Zimbabwe Dollar note was Z$100,000,000,000,000 – a 100 trillion.

What do I remember about that time? I for the most part was cushioned from the daily stresses this caused my parents and the general population of Zimbabwe. I was at a mixed boarding school in a country town far away from the craziness of daily life.

At weekends, however, we returned to our parents who were still farming just outside Harare. Here we were given some exposure to what Hyperinflation really meant.

Normal life, as one knows it, completely stopped and we became ‘hunters and gatherers’. The basic survival instinct for the human race since time began.

I remember my mother having to leave Zimbabwe to go and work in the UK and Zambia to earn the valuable US Dollar. Her company whose main client was a bank, could no longer afford to pay her a salary of any value. She would commute on a Monday morning up to Lusaka in Zambia and return on the Friday for the weekend. I quite liked her coming back and bringing us little goodies that she had bought at the local supermarket in Zambia. I remember distinctly her bringing Easter Eggs – what a treat! My father ran the affairs in Zimbabwe and kept the home fires burning including running around trading money to find food and supplies for both the home and the farm.

In 2007, the government declared inflation illegal. Any retailer who raised prices was arrested. This attempted to freeze prices but what this really caused was huge scarcity of goods. I remember going to the shops and seeing rows and rows of empty shelves. People would queue for hours for one loaf of bread or one bag of mealie meal. It was just heartbreaking. I remember my parent’s whole topic of conversation would be how they could get a whole lamb or 10 chickens to put in the freezer or buying loaves of bread on the ‘black market’.

We were luckier than many in that we were able to buy non-perishable goods from South Africa. This was exciting for my brothers and I, to see what the latest pallet contained. Sometimes some sweeties for us! My dad did all of this himself – he bought a trailer in order to go down to South Africa and do our own shopping. He would spend hours at the Beitbridge border along with all the other people doing the same journey and also all the traders who were making a living out of selling goods on the black market.

The problem was that the general populace were still being paid in Zimbabwe dollars and although they were being paid trillions, it only amounted to the equivalent of US $1. The government continued to print money, thereby increasing inflationary pressures and further devaluing the Zimbabwe Dollar.

My parents helped the staff on the farm by buying them hampers with all the basic commodities such as cooking oil, salt, mealie meal, green soap. I guess our farm workers were luckier than the people in town as they could grow some maize and rape which became their staple diet.

The prices in shops and restaurants continued to be quoted in Zimbabwe Dollars and were adjusted many times a day. If anyone received payment in Zimbabwe Dollars they would have to trade this for foreign currency immediately using illegal foreign currency traders in order to retain value. Many of these traders were picked up by the police and arrested.

Sadly, the only people that escaped the terrible impact of Hyperinflation were those with unlimited access to Zimbabwe Dollars and those that were politically connected to the ruling elite.

As I am writing this blog in 2020, Zimbabwe looks like it will be returning to Hyperinflation, inflation is currently running at 473% and the Zimbabwe Dollar versus US $ is currently at 33 : 1. In some ways it will be worse this time than previous as people remember this terrible period in recent history and know what to expect. My parents still live in Zimbabwe but all of us children are now living in UK or Australia.